Access Bank payday loan is a thing people remember in the first turn when it’s necessary to raise some money for urgent needs. It’s a quick loan, which is supposed to be repaid quickly and it’s a true first aid in certain situations.Payday loans online with a quick secure application and super fast approval. What Do You Need for a Payday Loan? You will need to give the lender your personal information, and this includes your This includes the bank’s name and telephone number, account type, account number, routing number.Payday loans are unsecured personal loans that are typically repaid on your next payday. “The biggest danger of payday loans is when they turn from a short-term stop gap into a long-term drain If your payday lender doesn’t require a hard credit check and you’re able to pay back the full amount.

Payday loans are unsecured loans, which means they don’t require collateral in exchange for receiving the money. This is one reason they’re attractive to borrowers, as they don’t have to fear repossession of their assets. How do payday loans work? There are typically two costs associated with payday.Do you need quick cash to pay a bill or cover an unexpected expense? You came to the right place! We offer guaranteed low rates on all Payday Loans. At Express Loans Of America, there are loans that can accommodate any financial situation you may be experiencing.Payday loans don’t require a credit check. If you pay back your payday loan on time, that loan generally won’t show up on your credit reports with any of the three Even forms of lending we don’t generally love, like credit card cash advances, tend to have lower interest rates than payday loans do.

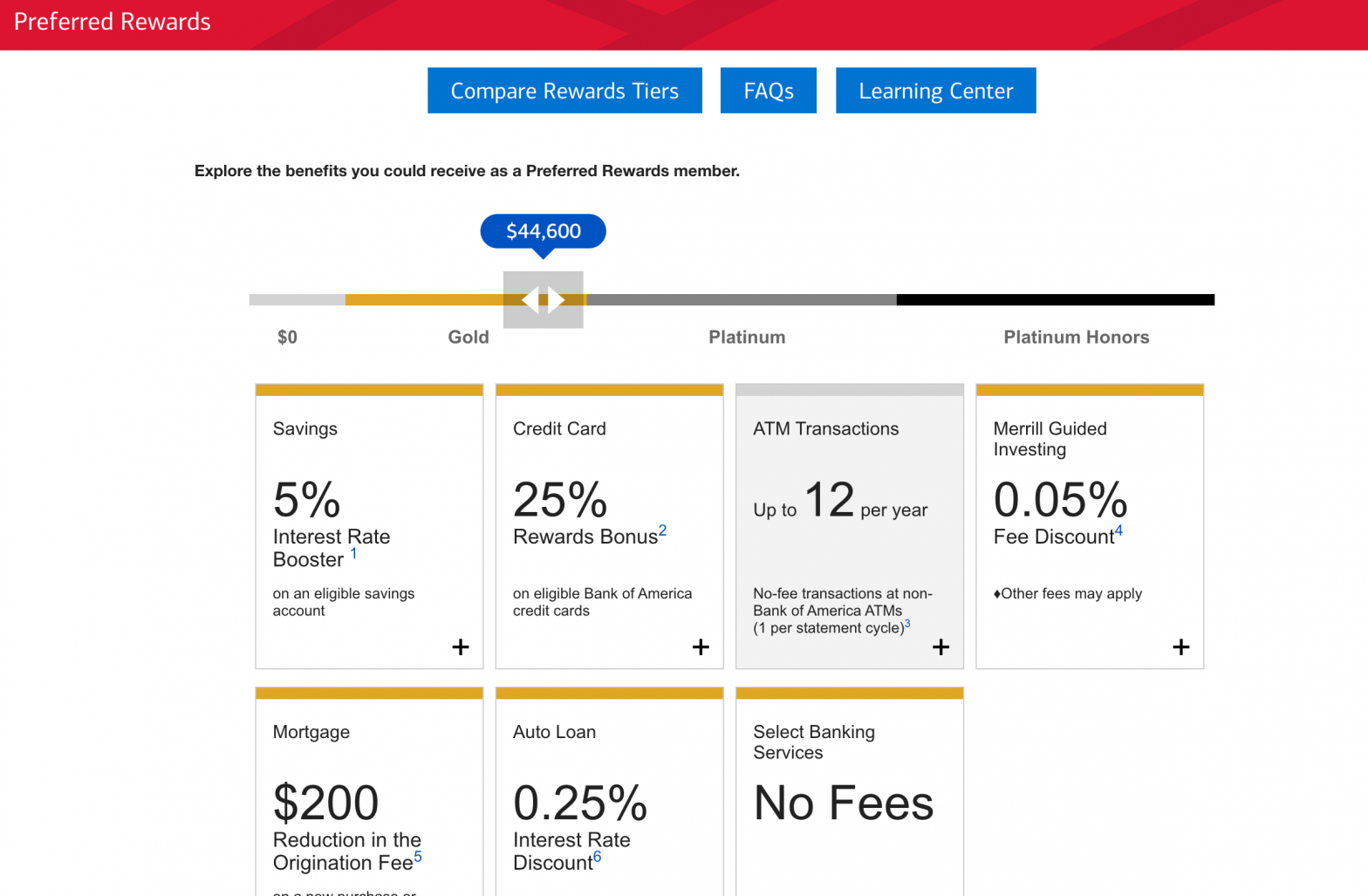

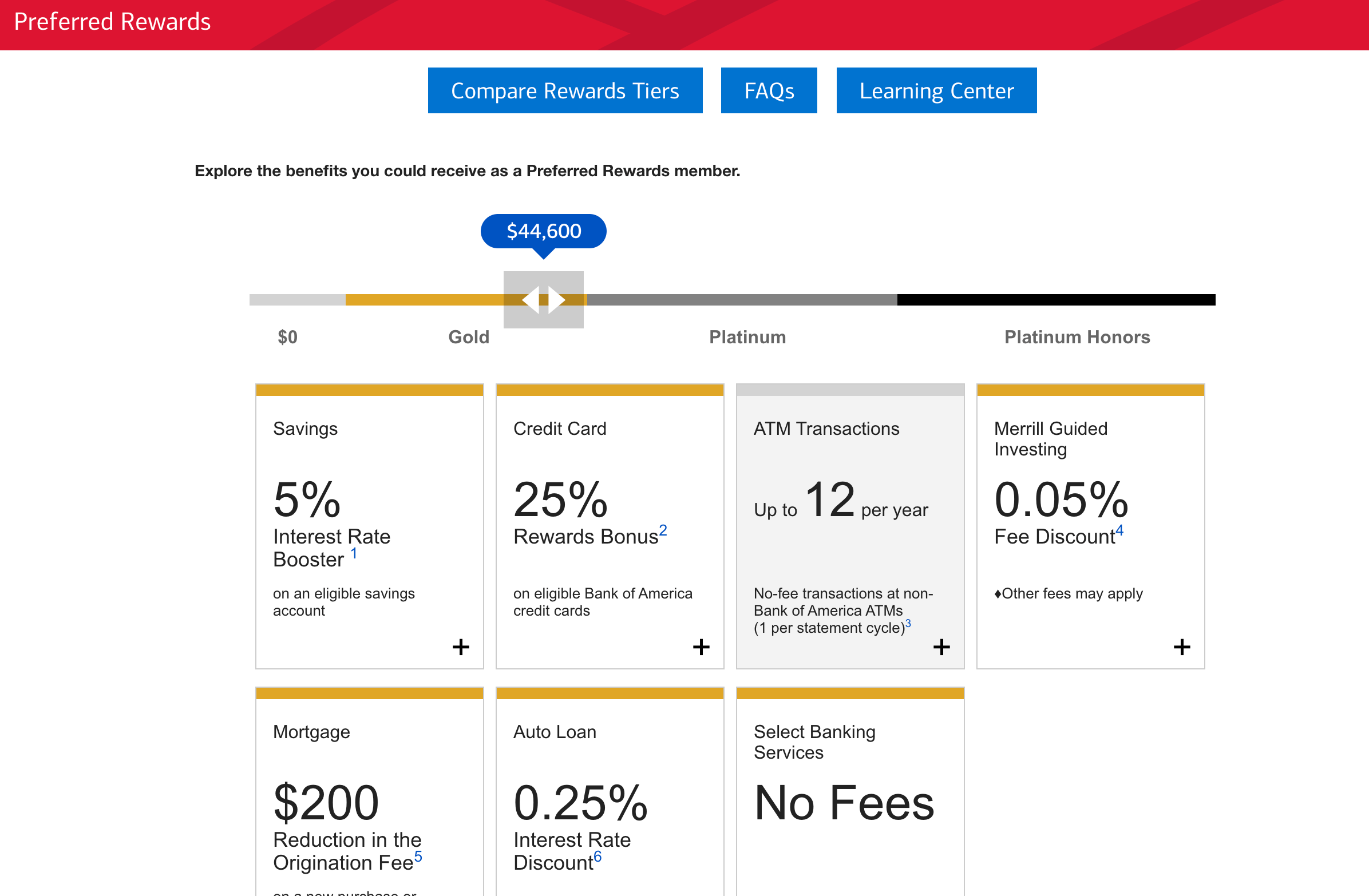

The loans are similar to traditional payday loans in that they can range in size from $200 to $1,000 and are meant to be paid off over a short period of (The CFSAA did not return a request for comment.) 80% of people who use payday loans roll them over. These loans have attracted criticism in large.Unfortunately, Bank of America does not offer personal loans. However, the bank does provide a variety of loans for specific needs, such as mortgages, auto loans, credit cards, business loans and lines of credit. We put together this guide to give you a quick overview of the loan products BofA.Payday loans are accessible to consumers with poor credit and usually do not require a credit check. About 12 million Americans use payday loans each year, and most of them do not have access to a credit card or savings account, according to the Pew Charitable Trust. Payday loans are risky, often.

Payday loans, which are sometimes called cash advances, are a form of unsecured short-term loans that are typically associated with very high interest rates. In this video we explore an example of a payday loan and use that to better understand the defining characteristics of a payday loan.Payday loan companies that accept debit cards, even ssi debit cards or ssa debit cards, are hard to find because business is so profitable most don’t care to offer the additional service to help people out with debit card loans with no bank account. However, those that do it will be pleased to have your as.Advance America offers payday loans online and in physical stores. The amount you can borrow depends on your state of residence and your current financial situation. Advance America offers a convenient chart that allows you to determine the finance charge, APR and total cost of the loan.

Payday loans generally charge a percentage or dollar amount per $100 borrowed. The amount of this fee might range from $10 to $30 for every $100 borrowed, depending on your state law and the maximum amount your state permits you to borrow. A fee of $15 per $100 is common.Bank of America will do a cash advance with your Bank of America credit card. Most payday loan companies, like Cash America and payday express, are happy to provide faxless payday loans, in fact preferring to give their loans in person.