Home Loans and other longer term loans are usually given out by banks/financial institutions at floating interest rates – where the interest rate applicable for the loan is linked to the interest rate set by the Central Bank and is periodically revised by the Central Bank.Floating-rate Home Loans seem cheaper than fixed-rate ones. So, should you consider fixed-rate loans at all? Read on to find out. Banks and non-banking financial companies offer both fixed and floating interest rates. Since interest rates are the most important aspect of any loan, getting it right.

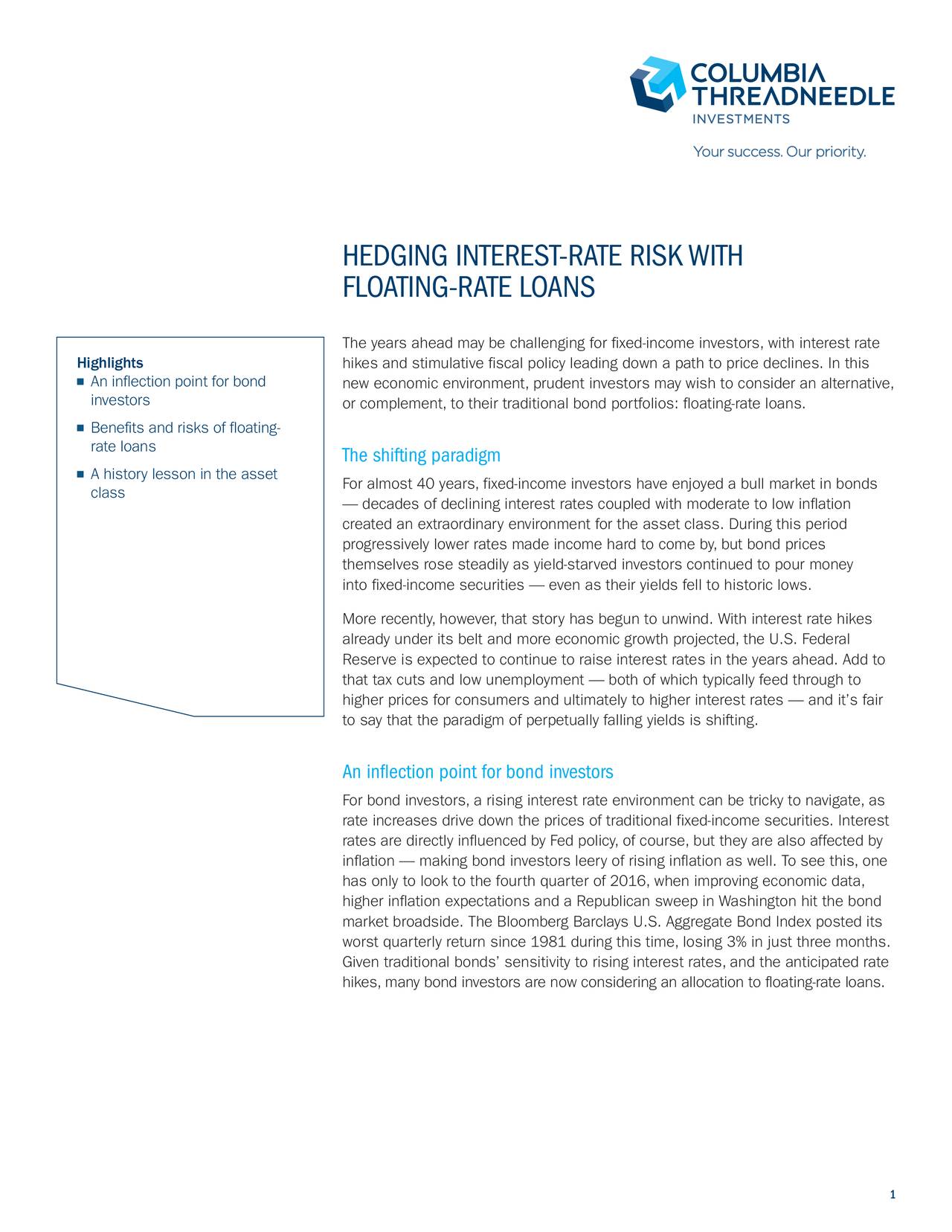

A floating rate loan is also known as a variable rate loan. With this loan your interest rate can go up and down in line with market conditions. A floating (Housing variable) interest rate loan may suit you if you want the discipline of making regular payments but also the flexibility to increase these and.Unlike traditional bonds, floating-rate bonds have variable interest rates that adjust periodically. They come with benefits as well as drawbacks. Similar to the federal funds rate, LIBOR is a benchmark rate used by banks making short-term loans to other banks. For instance, a rate could be quoted as.

The base interest rate for a floating-rate loan is the prime rate based on the Bank of Canada’s overnight rate. The lender negotiates an additional However, because most floating-rate loans are demand loans, the lender can also “demand” repayment in full at any time (though not likely if the.Floating-rate loans are debt obligations issued by banks and other financial institutions that consist of loans made to companies. They are called “floating rate” securities because the interest rates on the loans adjust at regular intervals to reflect changes in.

Banks or non-banking financial companies such as Bajaj Finserv offer home loans with floating interest rates that are usually lower than the fixed rates That means even when there is an increase in the floating interest rate, it can still be lower than the earlier fixed interest rates the bank had.The floating rate bonds have been launched in lieu of earlier withdrawn 7.75 per cent RBI bonds. The interest rate on the floating rate bonds will reset in every six months Government launches 7.15% floating rate bonds: Here’s all you need to know. ET OnlineLast Updated: Aug 20, 2020, 09:58 AM IST.

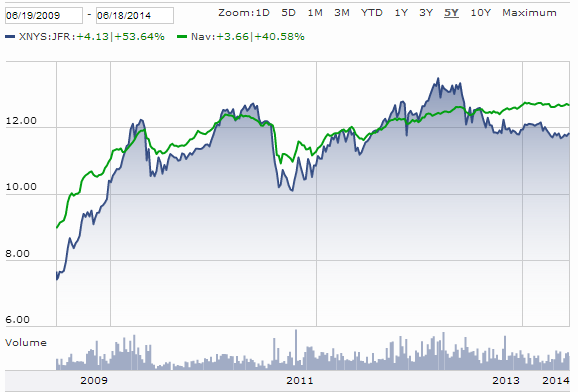

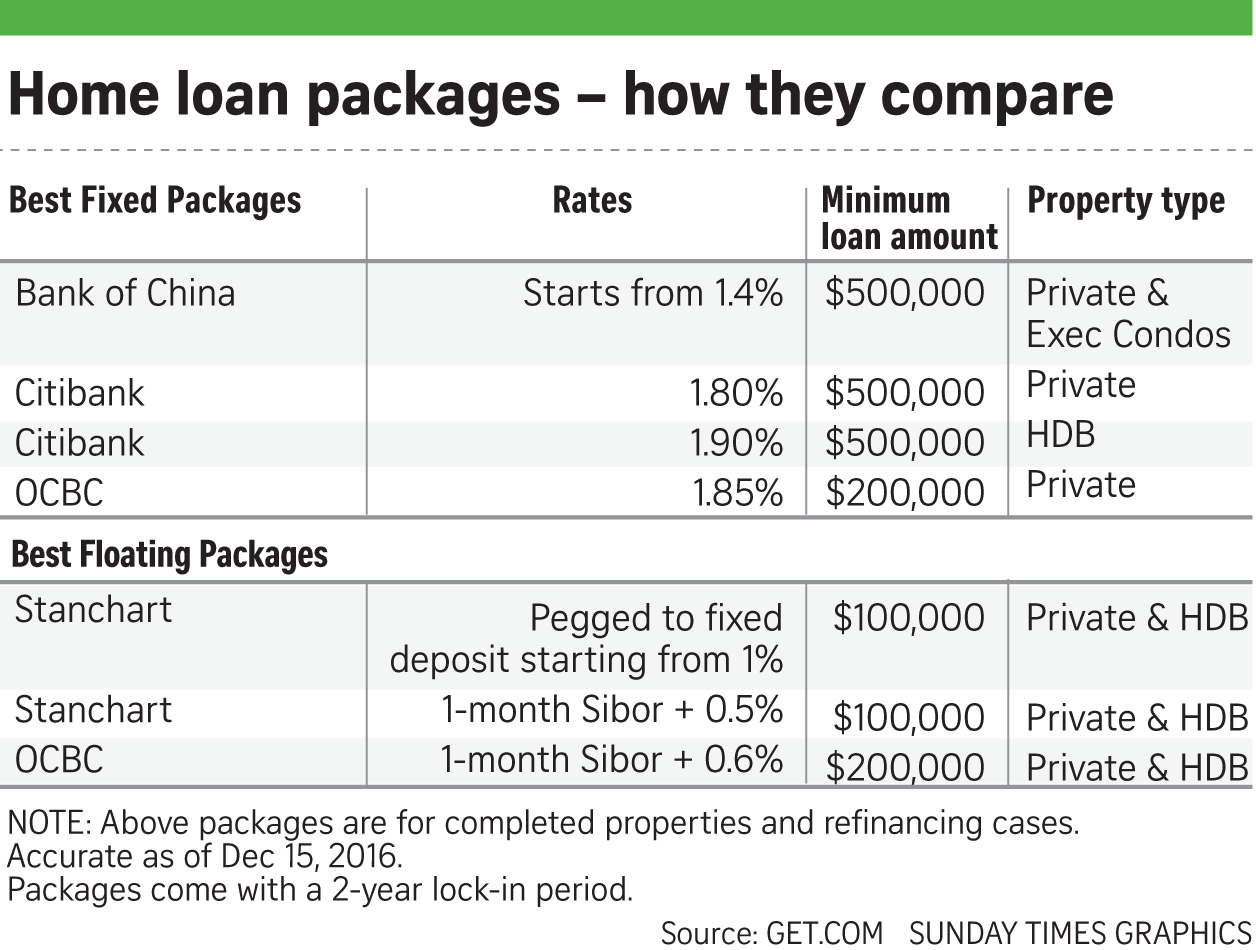

A Floating Rate Home Loan is where the interest rate varies. As a result both the interest rate applied to your loan and the amount you are required to Your bank statements from the last three months (from your main transaction account). Proof of income. Sales and purchase agreement (if applicable).Fixed vs floating home loan mortgage rates (2020). So yeah, if you’re hunting for a good bank mortgage, you should definitely consider getting one with a SIBOR-pegged home loan interest rate. Here’s an overview of the 3 types of floating rates and their indexes. Fixed rate is also indicated for.

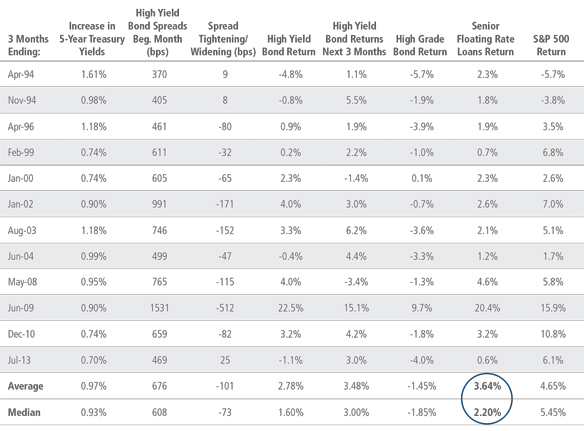

FLOATING RATE BANK LOAN CHARACTERISTICS The $600B bank loan market consists of companies with an average credit rating of B+ to B and loans with slightly higher ratings as a result of their senior secured status In the past decade.Liquidity Solution – Cash Concentration Liquidity Solution – Interest Enhancement Facility RMB Commercial Banking Services FAQ on RMB Commercial Banking Lending. Hang Seng Business Loan. Powering Up Your Business Success! More options. Floating Rate Instalment Loan Calculator.Bank loans look more attractive than high-yield bonds at the moment.

Home Loan Interest Rate : Reduced home loan interest rates by ICICI. The Bank lowered the MCLR(marginal cost based lending rate) by 0.10% to 8.95%. ICICI’s Home loans are quick and easy and the available at an attractive interest rate.Does it seem like interest rates have trebled over the last two years? Well, short-term commercial lending rates certainly have. A quick glance at a chart of three-month London Interbank Offered Rate (Libor) tells the tale.A floating rate home loan implies that the interest rates of the loan is subject to periodic adjustment, the frequency of which depends on the type of This is a Floating Rate home loan that is pegged to the Singapore Interbank Offered Rate, or SIBOR. When banks lend each other money in Singapore.