When a bank loans out $1,000, the money supply A. decreases. The First Bank of Fairfield Assets: 1. Reserves $1000 2. Loans $7000.Banks Central bank Commercial banks Special functions in the economy Profit making financial institutes Deposit Loan A B Deposit withdrawal + Interest Loan 16 Money supply with 100% reserve ratio In an economy without bank MS = Cash only If gov’t issues $1,000 cash, MS = $1,000 Having a.C. It Increases By More Than $1000. D. It Decreases By More Than $1000.So the bank gets 1000 from the FED and lends out 900 that same 900 is deposited into another bank and is lent out at a 10 percent reserve ratio. In other words when you go in and take out a loan the money doesn’t exist until you sign on the dotted line. All money is created in this way Money is Debt.

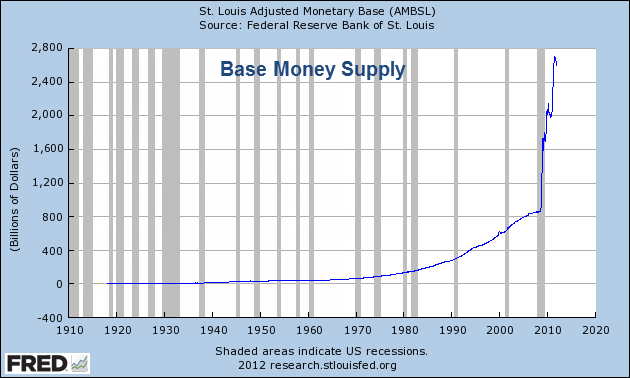

The Fed can influence the money supply by modifying reserve requirements, which generally refers to the amount of funds banks must hold against deposits in By lowering the reserve requirements, banks are able to loan more money, which increases the overall supply of money in the economy.Money Supply 1. Who affects the money supply? % reserve banking 3. Fractional reserve People deposit the $ 1000 in the bank, which the bank holds as reserves (R). All 100% of it are just held 2 3. Fractional reserve banking Now banks are allowed to make loans. Some reserves must still be kept.How did the money supply suddenly grow? When banks make loans, they create money. The borrower gets. $90 in currency (an asset counted in the. suggested that monetary developments. affect nominal variables, but not real variables.

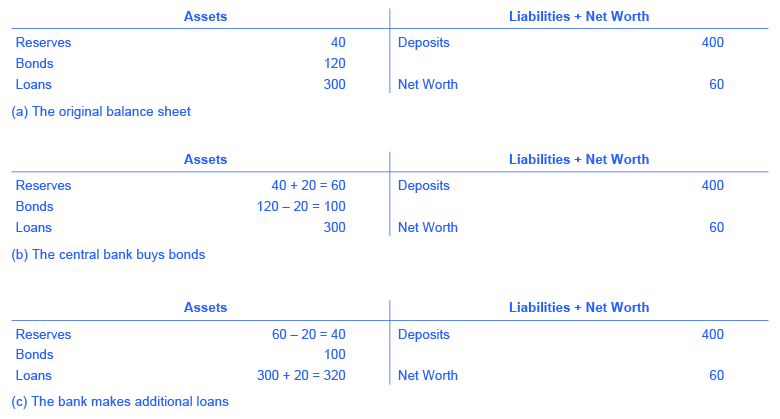

When the bank makes a loan, it will generally be for some length of time. If it lends Snavely Lumber $40,000 to buy a new forklift, the loan might have a term It will want to get Fed liabilities in exchange for the Fulton bank’s liabilities (requiring Fulton Bank to pay out of its reserves) before depositing that.Lowering the required amount will increase the supply of money that banks can lend to businesses and individuals, and therefore cutting borrowing costs. The monetary policy tool involves the central bank buying up existing loans from commercial lenders, giving them some extra liquidity.How to borrow money with a bank loan. “Taking out a personal loan to pay down high-interest credit card debt can boost your credit score by lowering your credit utilization ratio,” says Young. The terms of the loan are in months and can range from 12 to 96 months. When you complete the loan.